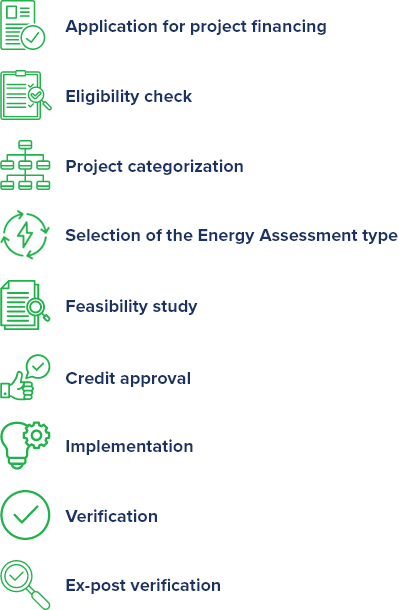

Typical Steps of Financing

Typical Steps of Financing

Green financing mechanisms and programs in each country play an essential role in raising the level of investments in small and medium distributed renewable energy and energy efficiency projects. Some SEMCs countries; compared to the rest of the countries, have a larger number of available financing mechanisms, mostly supported by international financing institutions through a group of national banks, including, for example, Egypt and Morocco. Most credit lines in green finance mechanisms have a common financing approach, including:

- Submitting a project financing application form

- Examining eligibility criteria to determine the creditworthiness of the project.

- Classifying the project in terms of level of complexity to determine the type of evaluation required to approve funding. A typical project that can be quickly evaluated through a fast- track or simplified process using pre-established models, or it may require more in-depth detailed assessments for medium or high complexity projects.

- Examining and evaluating the feasibility, and the extent to which the requirements for energy savings and emissions reductions are achieved.

- Approval of financing.

- Implementation and operation.

- Verifying implementation, operation, and achieving the required indicators (Ex-post verification as these credit lines are usually equipped with either a financial grants or a technical assistance component)